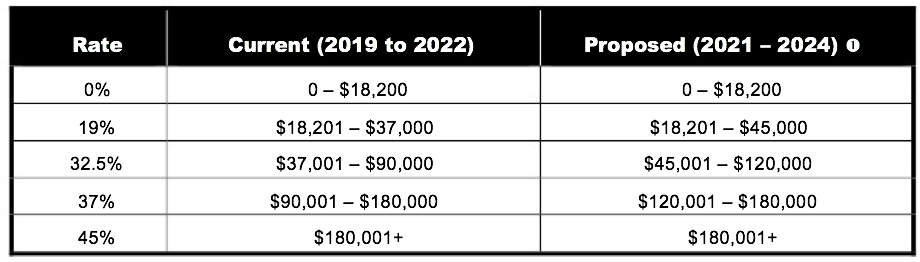

1.1 Changes to personal income tax rates

The Government has announced that it will bring forward changes to the personal income tax rates that were due to apply from 1 July 2022, so that these changes now apply from 1 July 2020 (i.e. from the 2021 income year). These changes involve:

- increasing the upper threshold of the 19% personal income tax bracket from $37,000 to $45,000; and

- increasing the upper threshold of the 32.5% personal income tax bracket from $90,000 to $120,000.

These changes are illustrated in the following table (which excludes the Medicare Levy).

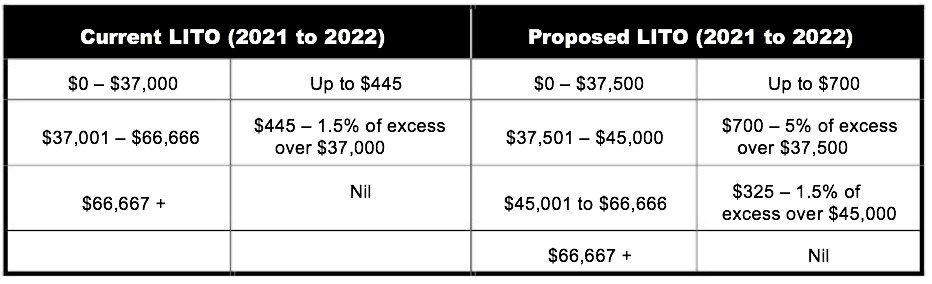

1.2 Changes to the Low Income Tax Offset (‘LITO’)

The Government announced that it will also bring forward the changes that were proposed to the LITO from 1 July 2022, so that they will now apply from 1 July 2020 (i.e. from the 2021 income year), as follows:

- The maximum LITO will be increased from $445 to $700.

- The increased (maximum) LITO will be reduced at a rate of 5 cents per dollar, for taxable incomes between $37,500 and $45,000.

- The LITO will be reduced at a rate of 1.5 cents per dollar, for taxable incomes between $45,000 and $66,667.

Source: National Tax & Accountants’ Association Ltd: 06 October 2020