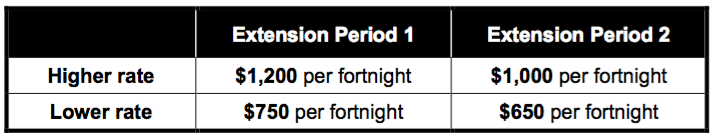

From 28 September 2020, a two-tiered payment system will apply with respect to JKPs. In addition, the amount of the JKP will also be dependent on the fortnight in question, as set out below:

The payment rate applicable to an employee is determined by reference to the actual hours the employee worked, had paid leave and paid absence on public holidays over an applicable ‘reference period’ (refer below). Specifically, the applicable rate is determined as follows:

- Higher rate – If an employee’s total hours were 80 hours or more for the employer over an applicable 28-day reference period, then the employer is entitled to the higher rate in respect of that employee.

- Lower rate – If the total hours of work and equivalent paid leave are less than 80 hours over the applicable 28-day reference period, the lower rate applies.

It is the responsibility of the employer to determine the number of hours that count towards the threshold for an eligible employee, based on existing records that are already maintained in respect of that employee.

3.1 ‘Reference periods’ for employees

There are two standard reference periods for all employees, which consists of the 28-day periods ending at the end of the most recent pay cycle for the employee ending before: 1 March 2020 – which is the original reference date; or

- 1 March 2020 – which is the original reference date; or

- 1 July 2020 – which is the additional reference date for conditions that apply to newly eligible employees of qualifying employers for JobKeeper fortnights starting on or after 3 August 2020.

TAX WARNING – Employers cannot choose the reference period

These reference periods effectively cover the last two consecutive fortnightly pay periods (or the last four consecutive weekly pay periods) ending prior to 1 March 2020 or 1 July 2020. Importantly, both reference periods are applicable to all eligible employees, irrespective of whether their eligibility is based on the 1 March 2020 or the 1 July 2020 requirements.

Also, employers do not have a discretion to choose which reference period to apply and must have regard to any applicable reference period for any employee that results in the higher rate applying. In other words, the employer is required to apply the most beneficial reference period for their employees.

Where these standard reference periods are not considered to be a suitable reference period for a class of employees, the Commissioner has the power to determine, by legislative instrument, an alternative reference period for the hours worked test for particular employees. Refer to Coronavirus Economic Response Package (Payments and Benefits) Alternative Reference Period Determination 2020.

Where the relevant pay cycle for an employee is longer than the 28-day reference period (such as a monthly pay cycle) then a pro-rated calculation is used to determine the applicable hours of the longer pay cycle that are attributable to the relevant 28-day period.

Employees who already qualify under the standard reference period will not lose eligibility if they would not meet the relevant threshold under an alternative reference period determined by the Commissioner (if an alternative reference period is determined in respect of the employees). By the same token, employers must always consider whether the higher rate might apply under an alternative reference period, where an employee is not otherwise eligible for the higher rate under a standard reference period. As a result, employers must be aware of any applicable alternative reference periods that are determined by the Commissioner, if, or when, they become available.

3.2 Commissioner’s power to determine high rate applies

In circumstances where the Commissioner is satisfied that the total hours that count towards the threshold are not readily available, the Commissioner has the power to determine, by legislative instrument, methods for identifying if a class of employees qualify for the higher rate.

For example, this would apply if an employer does not have any record, or has incomplete records, of the hours worked (or paid leave or paid absences on public holidays) by its employee during a period. In contrast, this power would not be exercised if a class of employees was only employed for part of the reference period or took unpaid leave during part of this period (in which case, the Commissioner may separately determine an alternative reference period instead – refer above).

From a practical perspective, it is anticipated that this power will be exercised by the Commissioner in assisting employers who are more likely to have issues working out the number of hours worked by an employee.

This may be the case for employees who are not remunerated based on an hourly rate or contracted number of hours (e.g., employees who undertake duties principally on a commission, piece rate or similar basis over the reference period and their remuneration is not necessarily proportional to the actual hours worked in a particular period. Refer to Coronavirus Economic Response Package (Payments and Benefits) Higher Rate Determination 2020.

Source: National Taxation & Accountants’ Association Ltd : September 2020